Whether you’re contemplating building work your household, to order a new home with immediate recovery requires, or building a custom-built home from the crushed right up, First Real estate loan can help with a construction or restoration mortgage that fits their installment loans Memphis no credit check precise needs. Our very own knowledgeable and you can imaginative credit professionals see funding about surface up!

If you are building or remodeling property may appear complicated, its the employment to ensure its as smooth once the possible.

The borrowed funds processes begins with a first appointment together with your Loan Manager. Together with her, might description desires and you may assess your debts. This may give a much better understanding of the borrowed funds number you will get qualify for. Here is what we provide at all times.

The first step towards property purchase is getting pre-qualified for financing. Your loan Administrator usually review debt recommendations to discover how much you are capable to borrow. Due to the fact a good pre-accredited visitors, your offer towards a house is much more apt to be approved.

Loan Planning Number

- Duplicate out-of photo ID

- Public Safety amount

- Duplicates away from examining and you can family savings statements for the past step three months

- Most recent spend stubs detailing your own history 30 days out-of employment

- Government tax statements having W-2s, K-1’s, 1099 over the past a couple of years

- Proof some other possessions for example holds and you can ties

- Contact name and address of someone who’ll ensure your a career

Once the everybody’s condition is unique, more paperwork could be required. The loan Administrator allow you to know exactly what is needed.

Very first, identify a property that needs works that you want in order to redesign. Following that, you’ll deliver the adopting the into the loan manager to arrange initial rates and make certain your qualify for this type of assets and reount. You’ll then receive a pre-approval page to make the deal.

1: The first step regarding the recovery process could well be scheduling an enthusiastic appointment with a licensed consultant off HUD’s representative roster; they make it easier to dictate the required products which need certainly to performed to get the household around the minimum possessions standards into appraisal and help your devise brand new range regarding work for the like to-listing things (the new representative is only needed for the standard items of your own res).

Step two: Get contractors over to the home observe the property and see bids from them among the list of necessary and you will wished home improvements.

Step 4: The chip have a tendency to get in touch with the fresh company to obtain the necessary papers to make certain they meet the qualifications to do the newest performs.

Step 5: Your associate commonly change his very first are accountable to echo the newest contractor’s figures and remove people desired stuff you have selected to eliminate and/otherwise create any additional desired and you can eligible fix products which was in fact instead of the first number.

Step 6: Once you have decided the last extent away from really works that you want to incorporate in the borrowed funds, the fresh new assessment will likely be ordered, in fact it is done towards the an afterwards-improved basis, looking at the task in fact it is done to the fresh domestic within the financing.

Action seven: Once you’ve considering all of the needed documents consequently they are pre-eligible for the borrowed funds, that is a percentage of the less of the purchase pricing (price + renovations) or the after-increased appraised well worth, the loan can go to closing.

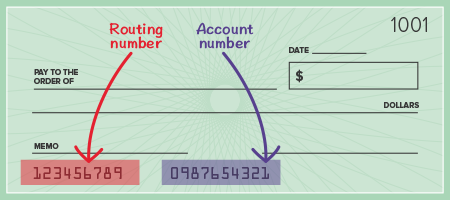

About months before settlement, you may be delivered last records about your financing, like the Closing Revelation. You need to feedback, sign and you can get back the fresh documents a minimum of 3 days past on booked closure big date.

The loan Officer, or a designated employee, will tell you how much cash you need to personal in your home.

What are the results toward closure big date:

![]()

- Talk with your own settlement agent as well as your Financing Administrator, or appointed staff member.

- Provide finance toward title company to fund the downpayment, settlement costs, taxes, insurance policies and other will set you back.

- You and the vendor often perform the closing data files so that the payment broker is also properly list the acquisition of your house.

Throughout Blog post Closing, their specialist can start the work. You will begin making money and this functions exactly like good practical loan unless of course you have funded payments towards the loan having whenever the home could well be uninhabitable in recovery (please consult with your mortgage officer to decide whether or not this might be possible for your loan).