Your bookkeeper will assist you with setting up your chart of accounts, connecting your banks, and creating a plan to clean up any existing data. Bench’s Essential plan is $249 a month and includes monthly bookkeeping and a dedicated bookkeeping team. We’ve looked at dozens of companies offering bookkeeping services and narrowed it down to what we think will work best for small businesses. Each may offer slightly different services and features, so choose the one that best suits your business needs. You can use the pricing tool on the Bookkeeper360 website to test out all the pricing combinations for each plan. Virtual bookkeeping services can also save you money through tax preparation services and tax filing, providing peace of mind that you’re 100% compliant with all tax rules.

Bookkeeper.com: Best for Bookkeeping and Financial Planning

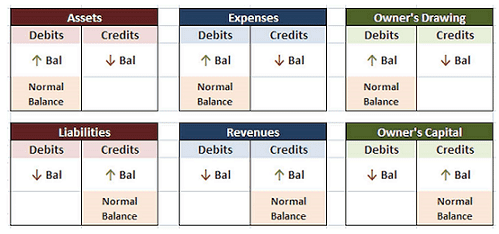

If not done at the time of the transaction, the bookkeeper will create and send invoices for funds that need to be collected by the company. The bookkeeper enters relevant data such as date, price, quantity and sales tax (if applicable). When this is done in the accounting software, the invoice is created, and a journal entry is made, debiting the cash or accounts receivable account while crediting the sales account. Bench offers full-service bookkeeping services for small business—with all of their plans including both a dedicated bookkeeping team and an easy-to-use software system.

Assign Transactions to Specific Accounts

This method is more suitable for larger businesses with frequent credit transactions. Join your local Chamber of Commerce and attend networking events to make personal connections with business owners and managers. Be ready to share information about your firm and the services you provide.

Why You Should Import Transactions and Bank Balances

If you don’t walk away from your initial interactions with your prospective virtual bookkeeping service feeling 100% confident that this company has your back, then just say no. Outsourced, virtual bookkeeping can cost as little as $150 per month and as much as $900 (or more) per month. Some companies charge by the number of accounts you need them to manage, while other companies charge based on your company’s monthly expenses. Typically, the lower your expenses (and the fewer your accounting needs), the less you’ll be charged.

- No add-on services, like tax planning or accrual basis accounting, outside of catch-up bookkeeping.

- We use product data, strategic methodologies and expert insights to inform all of our content and guide you in making the best decisions for your business journey.

- It doesn’t offer a mobile app or unlimited meetings, so Bench is a better option in this case.

- Small business owners you meet at these events and organizations may become your ideal clients.

- We believe everyone should be able to make financial decisions with confidence.

- Simply turn your financial statements over to your CPA or other tax filings expert, and let them handle the rest.

- She has also written extensively on parenting and current events for the website Scary Mommy.

Whereas Bookkeeper.com only accommodates businesses that use QuickBooks, however, Bookkeeper360 works with those that use QuickBooks or Xero. Answer a few questions about what’s important to your business and we’ll recommend the right fit.

Bookkeeping and Accounting Undergraduate Certificate

A small business can likely do all its own bookkeeping using accounting software. Many of the operations are automated in the software, making it easy to get accurate debits and credits entered. Offers less expensive plans for businesses that need tax support and a dedicated accountant, but not bookkeeping assistance.

Chart of Accounts

Scrambling at the last second to gather documents for tax season is stressful, and rushing bookkeeping-related tasks can make you vulnerable to compliance issues and missed growth opportunities. Thankfully, online bookkeeping services have lowered the financial barrier to getting bookkeeping and tax-related help. Lots of bookkeeping services are built to run on QuickBooks, an industry leader in accounting and bookkeeping software. Some services also support Xero, another popular cloud-based accounting software. If you’re comfortable with your current software, ensure your bookkeeping service supports it.

For every new small business, it might not make sense to hire a bookkeeper straight away. But as soon as you see growth in your company, it will soon be essential to have a highly detailed, consistent bookkeeping approach. While you can manage your own accounting during the business bookkeeping services initial stages of your small business, it’s best to make the investment in a qualified, professional bookkeeper to ensure your success in the long term. The specific amount of an emergency fund may depend on the size, scope, and operational costs of a given business.

- Along with offering the typical outsourced bookkeeping services, AccountingDepartment.com provides outsourced controller services.

- In some cases, these services will include a bookkeeping or accounting software and a virtual team of bookkeepers to manage that system.

- The bookkeeper can be paid as a contractor and work as little or as much as the business needs.

- They can also send PDF copies of key financial reports including your profit and loss statement and balance sheet.

- For both sales and purchases, it’s vital to have detailed, complete records of all transactions.

A professional accountant (or Certified Public Accountant) can help with business tax planning, file your corporate tax return, and make suggestions to help you improve cash flow. If your small business needs financing, whether it’s business credit cards or small business loans, you may need up-to-date financial statements and/or business bank account statements. Staying on top of these crucial financial tasks can help your business qualify for financing. KPMG Spark is a fully online bookkeeping service that offers easy onboarding and integration with your bank. Bookkeeping focuses on recording and organizing financial data, including tasks such as invoicing, billing, payroll and reconciling transactions. Accounting is the interpretation and presentation of that financial data, including aspects such as tax returns, auditing and analyzing performance.